Matthew 18:19, 20

“19Again, truly I tell you that if two of you on earth agree about anything they ask for, it will be done for them by my Father in heaven. 20 For where two or three gather in my name, there am I with them.”

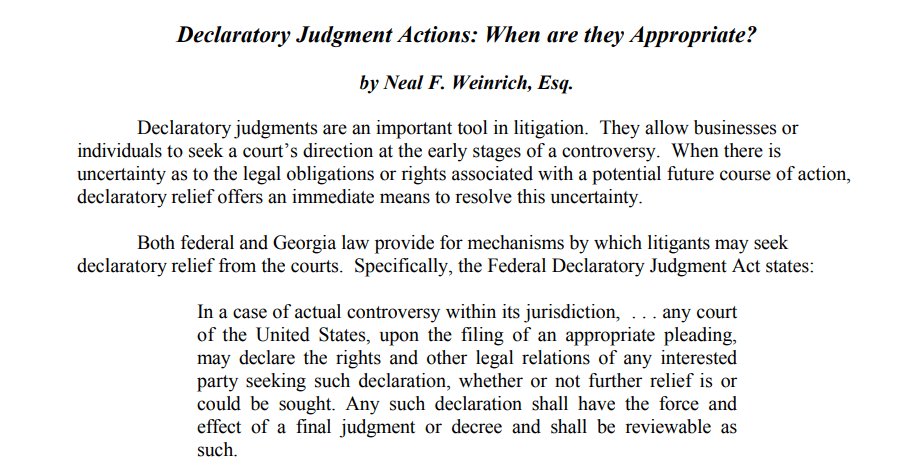

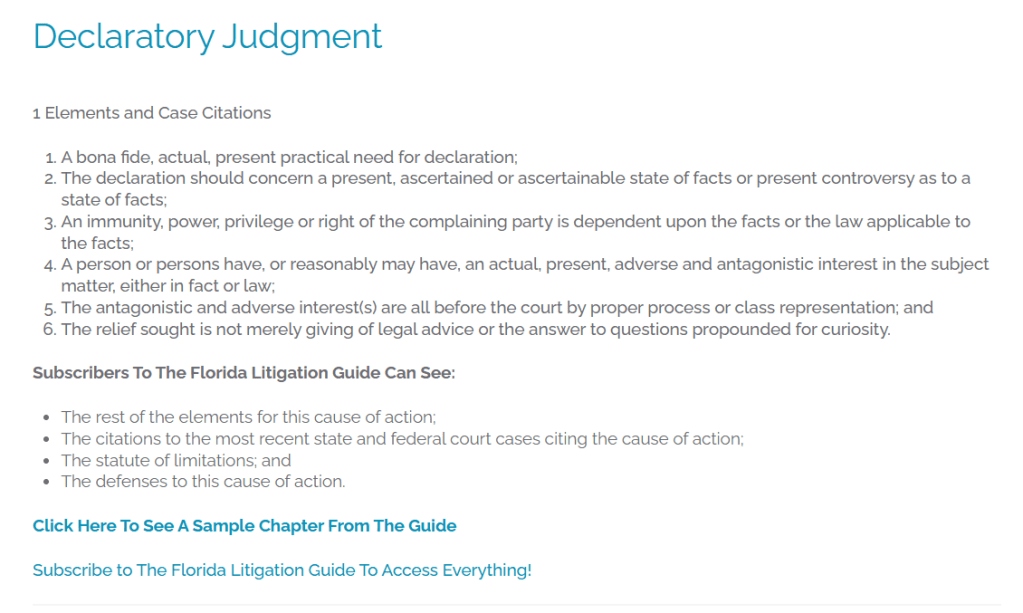

A declaratory judgment is a binding judgment from a court defining the legal relationship between parties and their rights in a matter before the court. When there is uncertainty as to the legal obligations or rights between two parties, a declaratory judgment offers an immediate means to resolve this uncertainty. However, because a declaratory judgment is often sought prior to the full development of a lawsuit, courts are sometimes hesitant to issue declaratory judgments, as they would prefer to see the case develop more before issuing a judgment. In typical civil actions, plaintiffs seek damages or injunctive relief to remedy an injury. In other words, there generally must be an injury for which the court can grant relief prior to a party bringing a lawsuit. Declaratory judgment actions are an exception to this rule and permit a party to seek a court judgment that defines the parties’ rights before an injury occurs. A declaratory judgment differs from other judgments because it does not provide for any enforcement or order a party to take any action or pay damages. Essentially, it states the court’s authoritative opinion regarding the exact nature of the legal matter and whether the parties would be entitled to relief without actually requiring the parties to do anything. For example, a declaratory judgment action could be brought to determine party rights and obligations under a contract or to establish the validity of a patent.

Under Article III of the U.S. Constitution, a federal court may only issue a declaratory judgment when there is an actual controversy. Without an actual controversy, the federal courts do not have jurisdiction to hear the case. For an actual controversy to be found, the plaintiff cannot be merely seeking advice from the court, but instead must show that the controversy between parties is substantial, immediate, and real and that the parties have adverse legal interests.

Rule 57 of the Federal Rules of Civil Procedure and the Federal Declaratory Judgment Act (Title 28, Section 2201 of the U.S. Code) govern declaratory judgments in federal court. The Federal Declaratory Judgment Act states:

“In a case of actual controversy within its jurisdiction, . . . any court of the United States, upon the filing of an appropriate pleading, may declare the rights and other legal relations of any interested party seeking such declaration, whether or not further relief is or could be sought. Any such declaration shall have the force and effect of a final judgment or decree and shall be reviewable as such.”

[Last updated in September of 2022 by the Wex Definitions Team]

Source: https://www.law.cornell.edu/wex/declaratory_judgment

What are Declaratory Statements?

What are Orders of General Application?

Did you know?

Where must actions for declaratory relief be filed?

from provemyfloridacase.com

What are Final Orders?

from flofr.gov

What are the conditions for a person to have an actual, present, adverse and antagonistic interest in the subject matter for a declaratory judgment?

from floridalitigationguide.com

What is the relief sought in a declaratory judgment?

from floridalitigationguide.com

What should be included in the prayer for relief section of a petition for declaratory judgment?

from legalbeagle.com

What is a declaratory judgment and what is its purpose?

from legalbeagle.com

What should be included in the summary paragraph of a petition for declaratory judgment?

from legalbeagle.com

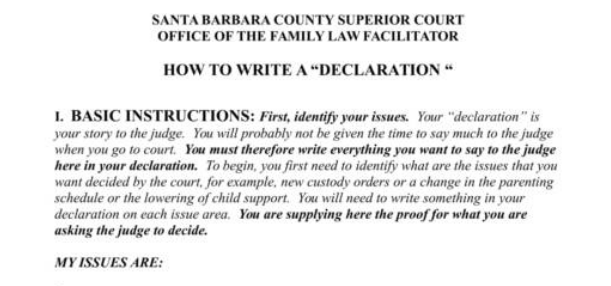

Drafting a Notice for an Order for Declaratory Statement to the Office of the Treasury is a formal process and it’s important to ensure that all the necessary legal requirements are met. Here’s a template that you can use as a starting point for your notice:

“`markdown

[Your Name or Company Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

Office of the Treasury

[Address of the Treasury Department]

[City, State, Zip Code]

Subject: Request for Order for Declaratory Statement

Dear [Treasury Officer’s Name or Office of the Treasury],

I/We, [Your Name or Company Name], hereby submit this notice in accordance with the procedures for obtaining a declaratory statement. I/We seek a declaratory order stating that I/we am/are not a taxpayer as defined under [specific tax statute or regulation].

1. **Identification of the Subject Matter:**

The subject matter of this request pertains to [specific tax statute or regulation] which defines the term ‘taxpayer.’

2. **Statement of Facts:**

The facts relevant to this request are as follows:

– [Detail the factual circumstances that lead to the belief that you are not a taxpayer under the specified statute or regulation.]

3. **Legal Basis:**

The legal basis upon which I/We claim not to be a taxpayer is as follows:

– [Cite the specific statutory or regulatory language that supports your position.]

4. **Issues for Determination:**

The issue for determination by the Office of the Treasury is whether the facts and circumstances of my/our situation exclude me/us from the definition of a taxpayer under [specific tax statute or regulation].

5. **Arguments Supporting the Request:**

– [Provide arguments and any legal precedents that support your request.]

6. **Conclusion:**

Based on the above, I/We respectfully request the Office of the Treasury to issue a declaratory statement confirming that I/We am/are not a taxpayer as defined under [specific tax statute or regulation].

I/We understand that the Office of the Treasury will review this request and may require additional information. I/We agree to provide any further information as required.

Thank you for your attention to this matter.

Sincerely,

[Your Signature (if sending a hard copy)]

[Typed Name]

[Title, if applicable]

“`

Please note that this is a general template and you may need to tailor it to fit your specific situation. It’s also advisable to consult with a legal professional to ensure that your notice meets all the necessary legal criteria and is appropriate for your particular circumstances.

Remember to include all relevant details and to follow any specific instructions provided by the Office of the Treasury or applicable laws and regulations. Good luck with your request!

Source: Conversation with Bing, 2024-05-16

(1) The Importance and Proper Use of Administrative Declaratory Statements. https://www.floridabar.org/the-florida-bar-journal/the-importance-and-proper-use-of-administrative-declaratory-statements/.

(2) INSTRUCTIONS FOR FILING A DECLARATORY JUDGMENT. https://columbiaclerk.com/wp-content/uploads/Declaratory-Judgment-Packet.pdf.

(3) Open Notices | U.S. Department of the Treasury. https://www.treasury.gov/initiatives/fsoc/rulemaking/Pages/open-notices.aspx.

(4) Do I need to submit draft notices through the CMS?. https://home.treasury.gov/faq-item/international-affairs/do-i-need-to-submit-draft-notices-through-the-cms.

(5) undefined. http://www.sunbiz.org.

_________________________________________________________

An estate’s capacity to be sued is determined “by the law of the state where the court is located.” See Rule 17(b)(3); see also Glickstein v. Sun Bank/Miami, N.A., 922 F.2d 666, 671 (11th Cir. 1991), abrogated on other grounds, Saxton, 254 F.3d at 963. Under Florida law, “it is well-settled that ‘an ‘Estate’ is not an entity that can be a party to litigation. It is the personal representative of the estate, in a representative capacity, that is the proper party.’ ” Spradley v. Spradley, 213 So.3d 1042, 1045 (Fla. 2d DCA 2017)

How is it the officers of the court can treat regular people as agents in representative capacity of an estate that doesn’t exist since we are the lawful living acting in personal private capacity for our own pleasure?

_______________________________________________________

https://images.sampletemplates.com/wp-content/uploads/2018/04/Court-Declaration-Statement-With-Writing-Instructions.jpg

__________________________________________________

https//www.bfvlaw.com/wp-content/uploads/2016/12/Weinrich-Declaratory-Judgment-Actions.pdf

_____________________________________________________

https://floridalitigationguide.com/declaratory-judgment/#:\

_____________________________________________________

https://provemyfloridacase.com/actions-for-declaratory-relief-declaratory-judgment/#:

______________________________________________________

https://www.floridabar.org/the-florida-bar-journal/the-importance-and-proper-use-of-administrative-declaratory-statements/

________________________________________________________

Leave a comment